Notice of 2024 annual meeting of stockholders of Teladoc Health

When

When

Thursday, May 23, 2024 |

Virtual meeting

www.virtualshareholdermeeting.com/TDOC2024

Virtual meeting

www.virtualshareholdermeeting.com/TDOC2024 |

Record date: March 28, 2024

Record date: March 28, 2024

Only stockholders of record at the close of business on March 28, 2024, may vote at the meeting or any adjournment(s) or postponement(s) of the meeting |

Date of distribution

Date of distribution

On or about April 9, 2024 |

- To enter the meeting, you must have your 16-digit control number that is shown on your 1) Notice of Internet Availability of Proxy Materials; or 2) proxy card if you elected to receive proxy materials by mail.

- You will not be able to attend the Annual Meeting in person.

- Details regarding accessing the Annual Meeting over the Internet and the business to be conducted are described in the Notice.

| Proposals | Board vote recommendation | ||

|---|---|---|---|

| 1 | To elect eight nominees to serve as directors | “FOR” | each director nominee |

| 2 | To conduct an advisory vote to approve our executive compensation (Say-on-Pay) | “FOR” | |

| 3 | To conduct an advisory vote to approve the frequency of future advisory votes on the compensation of Teladoc Health’s named executive officers | “1 YEAR” | |

| 4 | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2024 | “FOR” | |

| 5 | To transact other business as may properly come before the meeting or any adjournment(s) or postponement(s) of the meeting | ||

|

By Order of the Board of Directors, |

Even if you plan to virtually attend the meeting, we encourage you to vote as soon as possible using one of the following methods. Have your Notice of Internet Availability of Proxy Materials, proxy card or voting instruction form with your 16-digit control number available and follow the instructions.

| Internet

visit www.proxyvote.com, 24/7 |

Telephone

call toll-free |

Mail

complete, sign, date and return your proxy card or voting instruction form in the postage-paid envelope |

During the meeting

attend the virtual Annual Meeting and cast your ballot online |

Important notice regarding the availability of proxy materials for the annual meeting of stockholders to be held on May 23, 2024

The Teladoc Health proxy statement and annual report are available at www.proxyvote.com.

2023 Performance and company highlights

- For a full reconciliation of (i) net loss, the most directly comparable GAAP financial measure, to adjusted EBITDA and (ii) net cash provided by operating activities, the most directly comparable GAAP financial measure, to free cash flow, please see the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Consolidated Results of Operations” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Human capital management and diversity, equity and inclusion

At Teladoc Health, we live our values as a company through policies, governance, and deliberate investment in operating responsibly and sustainably. We are committed to making a positive impact in society and, perhaps even more importantly, to encourage others of like mind and spirit to join us in this critical work.

To fulfill our mission, we are focused on building a great company that becomes a global destination for amazing talent who want to build their careers, develop their capabilities, and grow both professionally and personally. We design a range of programs and initiatives to:

|

|

We build a range of total reward programs that support employees through fair, equitable, and competitive pay and benefits, and we invest in technology, tools and resources to transform and increase the quality of work.

We continue to look for ways to expand a range of programs and initiatives that are focused to attract, develop and retain our workforce—including a focused engagement through diversity, equity, and inclusion (“DEI”). We have enhanced our talent efforts in recent years to include:

|

We offer our employees full access to our diverse portfolio of whole-person health solutions, including:

|

We prioritize and invest in creating opportunities to help employees grow and build their careers, through training and development programs. These include:

|

We believe our business resource groups (“BRGs”), are a foundational element of the DEI ecosystem. Our seven BRGs include a focus on LGBTQ+, women, multicultural, military veterans, neurodiversity and differing physical and mental abilities, working parents and caregivers, and generational interests of employees who are engaged in four key pillars:

|

|

We embrace the opportunity and the responsibility to have a meaningful impact in our global community, using our voice and our resources to help expand equitable access to care, and create a better future for families and our neighbors. We continue to work toward further mobilizing our workforce to give back to the communities where we live and work through new volunteer programs and corporate matching opportunities for giving. We set out to advance positive social change in our communities with a 2023 achievement of volunteering more than 13,000 hours around the globe. This was a monumental achievement that was consistent with our values, including those of respecting and taking care of people, doing what’s right, and succeeding together. For 2024, we have continued to challenge ourselves and set goals for volunteer hours to do good and give back to our communities. |

||

|

We strive to build a culture of inclusion which includes regularly soliciting employee feedback through our pulse engagement surveys, listening circles and seeking opportunities to advance employee feedback. |

We have invested in our employees and broadened our external speaker series, interactive expert discussions, and self-paced learning programs to expand knowledge and awareness of diversity and health topics. |

We continue to broaden our diversity hiring manager training resources for performance-based interviewing, which included a screening tool to promote gender-neutral job descriptions. We expanded our corporate and college/university partnerships to advance our pipeline of diverse talent. |

Building stronger, healthier communities

We aim to do more than improve the healthcare experience. From our boots-on-the-ground efforts to our reform-on-the-Hill initiatives, we also strive to enhance the lives of the people and communities we serve.

In the aftermath of a natural disaster, urgent care and doctors’ offices can be slow to reopen due to power outages or damages. This year, we enabled free visits for communities recovering from natural disasters all across the U.S., helping families get access to necessary prescriptions and care. In addition, BetterHelp’s social good program enabled thousands of hours of free therapy for communities in need—from Ukraine to the Middle East.

Health equity

Our commitment to health equity is central to our mission of empowering all people everywhere to achieve their healthiest lives. We continue to make targeted investments to advance health equity by capturing and leveraging actionable data, designing for equity in our products and services, supporting the social drivers of health, and contributing to the industry's collective progress in this area via partnerships and collaboration.

As health equity increasingly becomes a regulatory and market differentiating reality for our Clients, Teladoc Health remains well positioned to meet the diverse needs, preferences, and circumstances of those whom we collectively serve. Our size, scale, and quality infrastructure enable us to continually assess and improve our services in order to deliver equitable access, experiences, and outcomes for all.

Corporate governance highlights

Corporate Governance Best Practices |

|

|

|

Board of directors overview

Director nominees

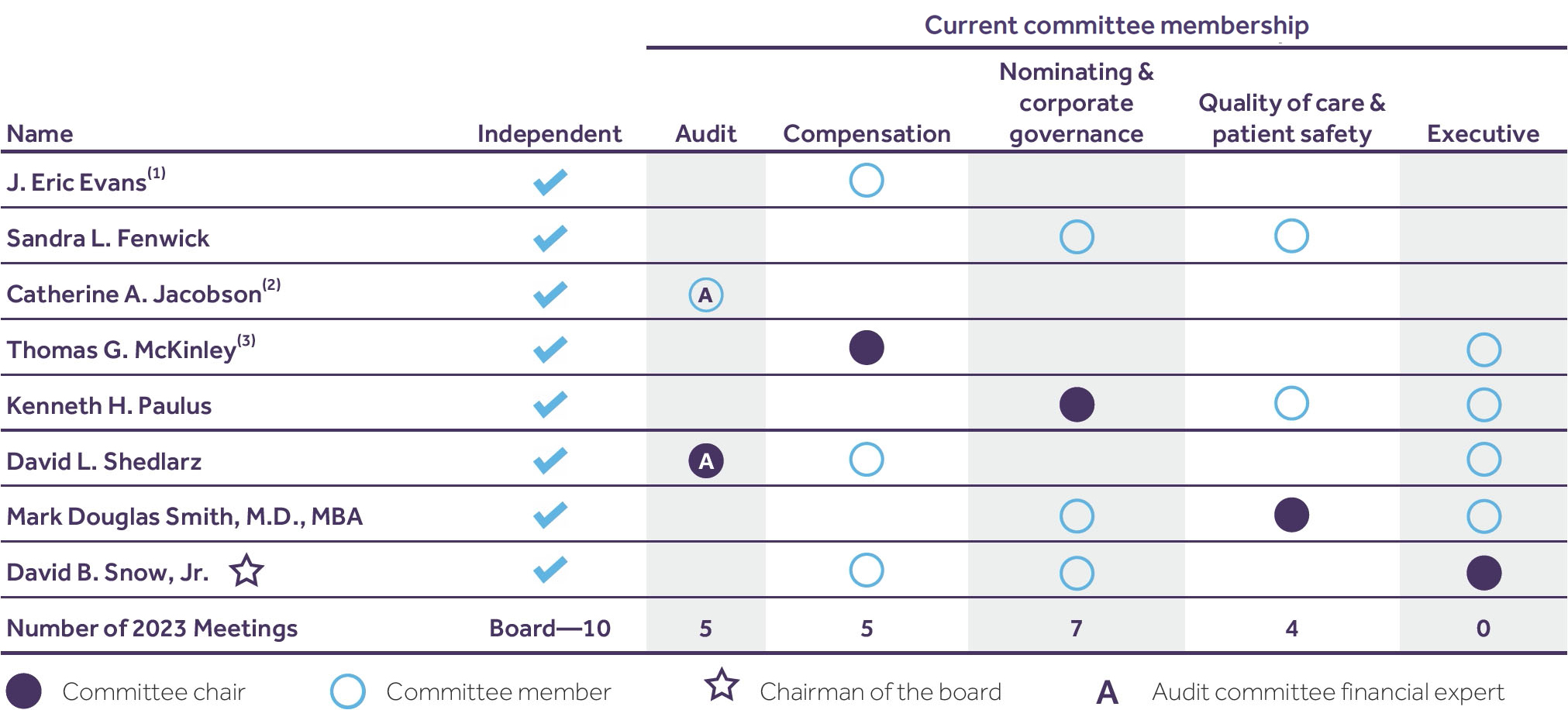

| Current committee membership | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Director nominee and principal occupation | Age | Director since | Independent | AC | CC | NCGC | QCPSC | EC | |

|

J. Eric Evans(1) Chief Executive Officer, Surgery Partners |

47 | 2023 |  |

|

||||

|

Sandra L. Fenwick Retired Chief Executive Officer, Boston Children’s Hospital |

73 | 2020 |  |

|

|

|||

|

Catherine A. Jacobson(2) Chief Executive Officer, Froedtert ThedaCare Health |

60 | 2020 |  |

|

||||

|

Thomas G. McKinley(3) General Partner, Cardinal Partners |

72 | 2009 |  |

|

|

|||

|

Kenneth H. Paulus Retired President and Chief Executive Officer, Prime Therapeutics |

64 | 2017 |  |

|

|

|

||

|

David L. Shedlarz Retired Vice Chairman, Executive Vice President and CFO, Pfizer |

75 | 2016 |  |

|

|

|

||

|

Mark Douglas Smith, M.D., MBA Clinical Professor of Medicine, University of California at San Francisco; and a board-certified internist |

72 | 2018 |  |

|

|

|

||

|

David B. Snow, Jr. Chairman of the board since 2014 Chairman and Chief Executive Officer, Cedar Gate Technologies |

69 | 2014 |  |

|

|

|

||

| Meetings in 2023 | Board ― 10 | 5 | 5 | 7 | 4 | 0 | |||

- Mr. Evans is expected to serve as Chair of the Compensation Committee and as a member of the Audit Committee and the Executive Committee following the Annual Meeting.

- Ms. Jacobson is also expected to serve as a member of the Quality of Care and Patient Safety Committee following the Annual Meeting.

- Mr. McKinley is expected to continue to serve as a member of the Compensation Committee and to serve as a member of the Audit Committee following the Annual Meeting. He is expected to leave the Executive Committee concurrently with Mr. Evan’s appointment as Chair of the Compensation Committee.

Executive compensation highlights

Our Compensation Committee has designed our executive compensation program in alignment with our key strategic priorities and commitment to aligning executive pay with corporate performance and stockholder interests. Accordingly, long-term incentives in the form of stock awards make up the significant majority of our named executive officers’ total target compensation such that their pay outcomes are directly linked to our stockholders’ experience.

Total 2023 target compensation mix

CEO

Average of other NEOs

Consideration of say-on-pay advisory vote

|

SIGNIFICANT STOCKHOLDER APPROVAL OF SAY-ON-PAY OVER LAST 3 YEARS

2021 – 87.2% |

Corporate governance and board matters

Proposal 1 Election of directors

Our Certificate of Incorporation and our Bylaws provide that the number of our directors shall be fixed from time to time by a resolution of the majority of the Board. Immediately prior to this Annual Meeting, our Board will consist of nine members, although there are only eight director nominees standing for reelection. The Board determined not to renominate Karen L. Daniel to stand for reelection, and her term will expire at the conclusion of the Annual Meeting. The Board determined that, effective at the conclusion of this Annual Meeting, the size of the Board will be decreased from nine to eight directors.

Director nominees

Each of the eight directors elected at this Annual Meeting will serve for a one-year term expiring at the 2025 annual meeting and until their respective successors have been duly elected and qualified. Upon the recommendation of the Nominating and Corporate Governance Committee, the Board has nominated the following individuals for election to the Board for a one-year term:

|

|

|

Each nominee has consented to being named in this proxy statement and has agreed to serve if elected. If a nominee is unable to stand for election, the Board may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the proxy holders will vote your shares for the substitute nominee.

The affirmative vote of a majority of the votes cast (excluding abstentions and broker non-votes) at the Annual Meeting is required to elect the director nominees as directors. This means the number of votes cast “FOR” a director nominee must exceed the votes cast “against” that director nominee.

|

J. Eric Evans, 47 | |

| Chief Executive Officer, Surgery Partners |

Independent Director since: September 2023 Committees: Compensation (effective following the Annual Meeting: Compensation, Chair, Audit and Executive) |

|

Career highlights SURGERY PARTNERS, INC., a leading provider of surgical services

TENET HEALTHCARE CORPORATION, a diversified healthcare services company

THE HOSPITALS OF PROVIDENCE IN EL PASO

|

Other current public company boards

Other current directorships and engagements

Education

|

||

|

Key experience and qualifications Our Board concluded that Mr. Evans should serve as a director because of his executive leadership experience and his extensive knowledge of the healthcare industry. |

|||

|

Sandra L. Fenwick, 73 | |

|

Retired Chief Executive Officer, Boston Children’s Hospital |

Independent Director since: November 2020 Committees: Nominating and Corporate Governance, Quality of Care and Patient Safety |

|

Career highlights BOSTON CHILDREN’S HOSPITAL, the nation’s foremost independent pediatric hospital and the world’s leading center of pediatric medical and health research

|

Other current directorships and engagements

Prior directorships

Education

|

||

|

Key experience and qualifications Our Board concluded that Ms. Fenwick should serve as a director because of her executive leadership experience and her extensive knowledge of the healthcare industry. |

|||

|

Catherine A. Jacobson, 60 | |

| Chief Executive Officer, Froedtert ThedaCare Health |

Independent Director since: February 2020 Committees: Audit (effective following the Annual Meeting: Audit and Quality of Care and Patient Safety) |

|

Career highlights FROEDTERT THEDACARE HEALTH’S HOSPITAL, a regional health care system based in Milwaukee, Wisconsin

RUSH UNIVERSITY MEDICAL CENTER

Other current directorships and engagements

|

Prior directorships

Recognitions

Education

|

||

|

Key experience and qualifications Our Board has concluded that Ms. Jacobson should serve as a director in view of her executive leadership experience and her extensive background in the healthcare industry. |

|||

|

Thomas G. McKinley, 72 | |

| General Partner, Cardinal Partners |

Independent Director since: November 2009 Committees: Compensation, Chair and Executive |

|

Career highlights CARDINAL PARTNERS, a venture capital firm focused exclusively on healthcare investing

PARTECH INTERNATIONAL, a global venture capital firm with offices in U.S., Japan, Israel and France

PREALIZE HEALTH (formerly CARDINAL ANALYTX) a project in conjunction with Professors Arnold Milstein and Nigam Shah at Stanford University

OPALA, a data automation partner that makes payer-provider collaboration radically easy

|

Other current directorships and engagements

Prior directorships

Education

|

||

|

Key experience and qualifications Our Board has concluded that Mr. McKinley should serve as a director in view of his significant director experience and his broad experience in the healthcare and technology industries. |

|||

|

Kenneth H. Paulus, 64 | |

| Former President and Chief Executive Officer, Prime Therapeutics |

Independent Director since: February 2017 Committees: Nominating and Corporate Governance, Chair, Quality of Care and Patient Safety and Executive |

|

Career highlights PRIME THERAPEUTICS, one of the nation’s largest pharmacy benefit managers

ALLINA HEALTH, one of the nation’s largest not-for-profit integrated delivery systems

ATRIUS HEALTH SYSTEM, one of the largest integrated physician organizations in New England and a teaching affiliate of Harvard Medical School

PARTNERS COMMUNITY HEALTH CARE

|

Other current directorships

Prior directorships

Education

|

||

|

Key experience and qualifications Our Board concluded that Mr. Paulus should serve as a director because of his executive leadership experience in the healthcare industry. |

|||

|

David L. Shedlarz, 75 | |

| Retired Vice Chairman, Executive Vice President and CFO, Pfizer |

Independent Director since: September 2016 Committees: Audit, Chair, Compensation and Executive |

|

Career highlights PFIZER, INC., a pharmaceutical company Former Vice Chair (2005 to 2007)

|

Prior directorships

Education

|

||

|

Key experience and qualifications Our Board concluded that Mr. Shedlarz should serve as a director because of his deep experience in public company finance, his experience as a director of large public companies and his prior service as the chief financial officer of one of the world’s leading pharmaceutical corporations. |

|||

|

Mark Douglas Smith, M.D., MBA, 72 | |

| Clinical Professor of Medicine, University of California at San Francisco; and a board certified internist |

Independent Director since: October 2018 Committees: Nominating and Corporate Governance, Quality of Care and Patient Safety, Chair and Executive |

|

Career highlights UNIVERSITY OF CALIFORNIA AT SAN FRANCISCO

SAN FRANCISCO GENERAL HOSPITAL

GUIDING COMMITTEE OF THE HEALTH CARE PAYMENT LEARNING AND ACTION NETWORK, a public-private partnership launched by the U.S. Department of Health and Human Services to promote the transition to value-based payment to improve care quality while lowering costs

CALIFORNIA HEALTH CARE FOUNDATION, an independently endowed philanthropy that works to improve healthcare access and quality for Californians

|

Other current public company boards

Other current directorships and engagements

Education

|

||

|

Key experience and qualifications Our Board concluded that Dr. Smith should serve as a director in view of his extensive background in the healthcare industry, including as a nationally recognized care delivery and health policy expert. |

|||

|

David B. Snow, Jr., 69 Board Chairman | |

| Clinical Professor of Medicine, University of California at San Francisco; and a board certified internist |

Independent Director since: February 2014 Chairman of the Board since: December 2014 Committees: Nominating and Corporate Governance, Compensation and Executive, Chair |

|

Career highlights CEDAR GATE TECHNOLOGIES, INC., a provider of analytic and information technology services to providers, payers and self-insured employers entering risk-based/value-based care reimbursement arrangements

MEDCO HEALTH SOLUTIONS, INC., a leading pharmacy benefit manager

|

Other current directorships

Prior directorships

Education

|

||

|

Key experience and qualifications Our Board concluded that Mr. Snow should serve as a director because of his broad experience in the healthcare industry and his significant core business skills, including financial, operations and strategic planning. |

|||

Corporate governance guidelines and code of business conduct and ethics

Our Board has adopted a Code of Business Conduct and Ethics applicable to directors, officers and employees that outlines our corporate values and standards of integrity and behavior and is designed to foster a culture of honesty and accountability, drive compliance with legal and regulatory requirements, protect and promote our reputation, as well as the preparation and maintenance of our financial and accounting information. Our Board has also adopted Corporate Governance Guidelines to assist it in the exercise of its responsibilities.

Our Chief Compliance Officer has responsibility to implement and maintain an effective ethics and compliance program and is responsible to provide updates on that program to the Nominating and Corporate Governance Committee. The Code of Business Conduct and Ethics and the Corporate Governance Guidelines are reviewed annually and periodically amended as the Board enhances our corporate governance practices and programs.

We intend to satisfy the disclosure requirements under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding any amendment to, or waiver from a material provision of our Code of Business Conduct and Ethics involving our principal executive, financial or accounting officer or controller by posting such information on our website. The Corporate Governance Guidelines and Code of Business Conduct and Ethics are available on our website at ir.teladochealth.com by clicking through “Corporate Governance.”

Board leadership structure

Our governance framework provides the Board with the flexibility to select the appropriate leadership structure for our organization. This will be driven by our strategic business needs, as well as the particular makeup of the Board at any point in time. As a result, no policy exists requiring the combination or separation of leadership roles, and our governing documents do not mandate a particular structure. The Nominating and Corporate Governance Committee annually reviews the structure and composition of our Board and its leadership structure to assess the effectiveness specific to our current business plans and long-term strategy.

Our current leadership structure consists of the Chairman of the Board, a separate Chief Executive Officer and a strong, active roster of independent directors. We believe that the cornerstone of strong corporate governance includes having a separate Chairman of the Board from our Chief Executive Officer, which allows our Chief Executive Officer to focus on managing the Company while leveraging our independent Chairman’s experience to drive accountability at the Board level and promote independent leadership of the Board. Therefore, we do not currently anticipate having the two roles filled by a single individual. As part of its evaluation whether to combine the two roles, the Board would consider, among other things, the Chief Executive Officer’s tenure and experience, the experience of our independent directors and the Board as a whole, whether or not it would improve the Board’s ability to focus on key policy and operational issues and help the Company operate in the long-term interests of our stockholders, as well as input from stockholders. Any such change would be announced to stockholders following such a determination.

|

Mala Murthy Interim chief executive officer and principal financial officer Since April 2024 The Chief Executive Officer is responsible for setting the strategic direction of the Company and for its day-to-day leadership and management. |

David B. Snow, Jr. Independent director since February 2014 The Chairman of the Board provides guidance to the Chief Executive Officer, directs the agenda for Board meetings and presides over meetings of the full Board. |

Another component of our leadership structure is the active role played by our independent directors in overseeing our strategic business objectives, both at the Board and committee levels. To promote open discussion among the independent directors concerning the business of the organization and matters concerning management, our Chairman of the Board presides over regularly scheduled executive sessions where the independent Board members meet without management present. The Chairman may also represent the Board in communications with stockholders or other key stakeholders and, along with the Nominating and Corporate Governance Committee, provide input on the design of the Board itself.

All eight of our director nominees are considered independent within the meaning of the rules of the New York Stock Exchange (the “NYSE”). All members of the Audit, Compensation and Nominating and Corporate Governance Committees satisfy the applicable independence criteria of the Securities and Exchange Commission (the “SEC”) and NYSE. Our Board has determined that each member of the Audit Committee is financially literate and each current member is an “audit committee financial expert” according to Item 407 of Regulation S-K promulgated by the SEC.

During 2023, each of our current directors attended at least 75% of the aggregate of the total number of meetings of the full Board held during the period that he or she served as a director, and the total number of meetings held by all committees of the Board on which he or she served during the period that he or she served as a member of that committee.

Committees of the board

The charters for the Audit, Compensation and Nominating and Corporate Governance Committees are available on our website at ir.teladochealth.com by clicking through “Corporate Governance.” The Quality of Care and Patient Safety Committee and Executive Committee are also governed by charters.

- Mr. Evans is expected to serve as Chair of the Compensation Committee and as a member of the Audit Committee and the Executive Committee following the Annual Meeting.

- Ms. Jacobson is also expected to serve as a member of the Quality of Care and Patient Safety Committee following the Annual Meeting.

- Mr. McKinley is expected to continue to serve as a member of the Compensation Committee and to serve as a member of the Audit Committee following the Annual Meeting. He is expected to leave the Executive Committee concurrently with Mr. Evan’s appointment as Chair of the Compensation Committee.

| Audit committee | |

|

FY2023 Meetings: 5

Current members

Qualifications

Report

|

Key responsibilities

The principal functions of the Audit Committee are to:

|

| Compensation committee | |

|

FY2023 Meetings: 5

Current members

Qualifications

Report

|

Key responsibilities

The principal functions of the Compensation Committee are to:

|

The Compensation Committee has the authority to retain or obtain the advice of compensation consultants, legal counsel and other advisors (independent or otherwise) to assist in carrying out its responsibilities. The Committee may delegate its authority under its charter to one or more subcommittees as is appropriate from time to time. The Committee may also delegate to an officer the authority to grant equity awards to certain employees, subject to the terms of our equity plans.

The Compensation Committee has engaged Aon’s Human Capital Solutions practice, a division of Aon plc (“Aon”), to assess and make recommendations with respect to the amount and types of compensation for our executives and directors. Aon reports directly to the Committee; however, our Chief Executive Officer consults with Aon with respect to its assessments of the compensation of other executive officers.

The Compensation Committee reviewed compensation assessments provided by Aon comparing our compensation to competitive market data. The Committee met with Aon to discuss the compensation of our executive officers, including the Chief Executive Officer, and to receive input and advice. The Committee has considered the adviser independence factors required under SEC rules as they relate to Aon and believes Aon’s work in 2023 did not raise a conflict of interest. For additional information regarding executive compensation in 2023, please see the section titled “Compensation Discussion and Analysis―Determination of Compensation.”

| Audit committee | |

|

FY2023 Meetings: 5

Current members

Qualifications

Report

|

Key responsibilities

The principal functions of the Audit Committee are to:

|

| Compensation committee | |

|

FY2023 Meetings: 5

Current members

Qualifications

Report

|

Key responsibilities

The principal functions of the Compensation Committee are to:

|

The Compensation Committee has the authority to retain or obtain the advice of compensation consultants, legal counsel and other advisors (independent or otherwise) to assist in carrying out its responsibilities. The Committee may delegate its authority under its charter to one or more subcommittees as is appropriate from time to time. The Committee may also delegate to an officer the authority to grant equity awards to certain employees, subject to the terms of our equity plans.

The Compensation Committee has engaged Aon’s Human Capital Solutions practice, a division of Aon plc (“Aon”), to assess and make recommendations with respect to the amount and types of compensation for our executives and directors. Aon reports directly to the Committee; however, our Chief Executive Officer consults with Aon with respect to its assessments of the compensation of other executive officers.

The Compensation Committee reviewed compensation assessments provided by Aon comparing our compensation to competitive market data. The Committee met with Aon to discuss the compensation of our executive officers, including the Chief Executive Officer, and to receive input and advice. The Committee has considered the adviser independence factors required under SEC rules as they relate to Aon and believes Aon’s work in 2023 did not raise a conflict of interest. For additional information regarding executive compensation in 2023, please see the section titled “Compensation Discussion and Analysis―Determination of Compensation.”

| Nominating and corporate governance committee | |

|

FY2023 Meetings: 7

Members

Qualifications

|

Key responsibilities

The principal functions of the Nominating and Corporate Governance Committee are to:

|

| Quality of care and patient safety committee | |

|

FY2023 Meetings: 4

Members

Qualifications

|

Key responsibilities

The principal functions of the Quality of Care and Patient Safety Committee are to assist the Board in fulfilling its oversight responsibilities relating to the review of our policies and procedures relating to the delivery of quality medical care to our members. The Quality of Care and Patient Safety Committee maintains communication between the Board and senior officers with management responsibility for medical care and reviews matters concerning:

|

| Executive committee | |

|

FY2023 Meetings: 0

Members

Qualifications

|

Key responsibilities

The principal function of the Executive Committee is to support the Board in the performance of its duties and responsibilities between regularly scheduled meetings of the Board. Subject to any limitations imposed by the Board, applicable law and our Bylaws, the Executive Committee may exercise the power of the Board in the management of our business and affairs with respect to matters referred to it by the Board and urgent matters requiring Board action that, in the determination of the Chairman of the Board, should not await the Board’s next regularly scheduled meeting. The Executive Committee consists of the Chairman of the Board and the chairs of our other standing committees, and meets on an ad hoc basis when circumstances necessitate. |

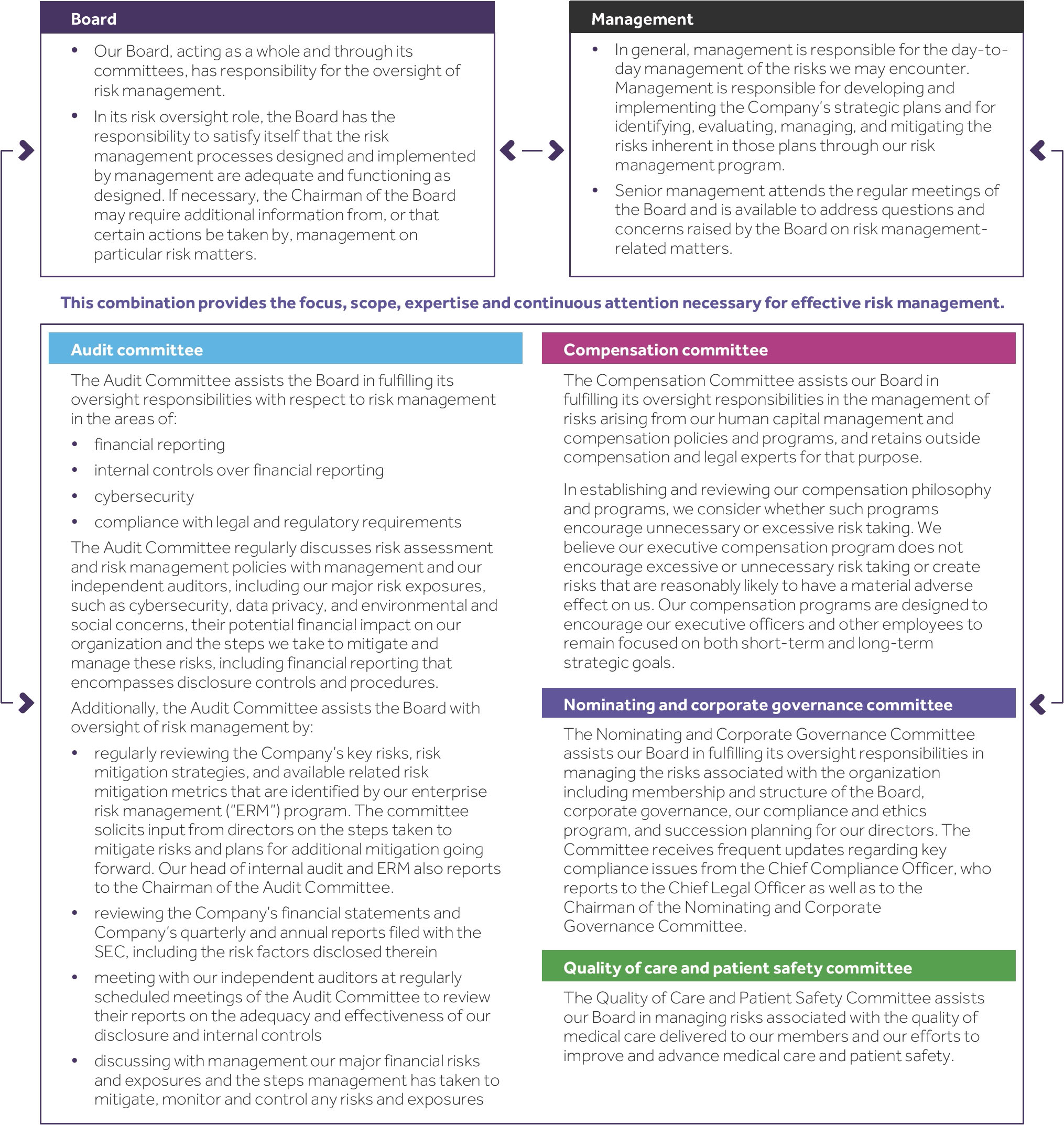

Board role in risk oversight

The Board believes that evaluating our executive team’s management of the risks confronting the Company is one of its most important areas of oversight. The Board further believes that taking an active role in the oversight of the Company’s corporate strategy and the related risks is appropriate, given our Board members’ combined breadth and depth of experience, and is critical to ensuring that the long-term interests of the Company and its stockholders are being served. The Board also encourages management to promote a culture that actively manages risks as a part of the Company’s corporate strategy and day-to-day business operations. The Board administers its risk oversight function both directly and through its committees. For risks that fall within a committee’s areas of primary responsibility and expertise, the Board assigns oversight to that committee, which then also apprises the full Board of significant matters and management’s response. The full Board directly oversees overall corporate risk and strategy and other matters that do not fall within the responsibility of a particular committee.

|

ENTERPRISE RISK MANAGEMENT PROGRAM To better anticipate, identify, prioritize and manage the key risks we may encounter, we have implemented an ERM program that was developed under the oversight of our Board and management. The ERM program is designed to:

As part of our ERM program we established an Aligned Risk Council (“ARC”). The role of ARC is to:

The outputs from ARC are reviewed by management in an interactive key risk ranking session. These outputs assist management validation of the Company’s risk profile. This session considers both current risks, including timeframes reflected by those risks, as well as emerging risks and future threats. The focus of the Board’s oversight varies based on the type and timing of the risk being discussed. For example, for a long-term risk, the Board focuses on advance planning. We believe our ERM program:

|

We recognize the increasing significance that cybersecurity has to our operations and the success of our business, as well as the need to continually assess cybersecurity risk and evolve our response in the face of a rapidly and ever-changing environment. Cybersecurity risk oversight continues to remain a top priority for our Board. The Audit Committee maintains primary responsibility related to overseeing our cybersecurity risk as part of its program of regular risk management oversight. This includes, but is not limited to, the overall maturity and strategy of our cybersecurity program. We have a rigorous and comprehensive cybersecurity program managed by a dedicated team of subject matter experts and is led by our Chief Information Security Officer (“CISO”), who has extensive cybersecurity experience. We have implemented telehealth industry standard processes, policies, and tools, including regularly scheduled vulnerability scanning and third-party penetration testing to reduce the risk of vulnerabilities in our system. Our CISO regularly engages with other members of our executive management team to discuss cyber risk, including the Chief Technology Officer, the Chief Information Officer, Deputy Chief Legal Officer, and Chief Compliance Officer, among others, as well as the Audit Committee. Our executive management team has the appropriate expertise, background, and depth of experience to manage risk arising from cybersecurity threats. Executive management has also participated in cybersecurity tabletop exercises to test our cyber response playbooks.

Identifying and evaluating director nominees

The Board is responsible for selecting director nominees. The Nominating and Corporate Governance Committee identifies candidates in consultation with management, through the use of search firms or other advisors, recommendations submitted by stockholders or current directors or other methods as the Committee deems to be helpful to identify candidates.

Once candidates have been identified, the Nominating and Corporate Governance Committee confirms that the candidates meet all of the qualifications for director nominees established by the Committee. The Committee may gather information about the candidates through interviews, detailed questionnaires, comprehensive background checks or any other means that the Committee feels appropriate in the evaluation process. Meeting as a group, the Committee discusses and evaluates the qualities and skills of each candidate, both on an individual basis and considering the overall composition and needs of the Board. Based on the results of this evaluation process, the Committee recommends candidates for the Board’s approval as director nominees.

When assessing director candidates, the Nominating and Corporate Governance Committee considers a nominee’s qualifications, skills and attributes, including depth and breadth of professional experience and independence. A nominee must, at a minimum, have demonstrated exceptional ability and judgment and be of the highest personal and professional integrity. The Committee does not have a formal policy with respect to diversity; however, the director nomination process is designed to ensure the Board considers members with diverse backgrounds including race, ethnicity, gender, knowledge, experience, skills and expertise, as applicable to our industry. The Board assesses its goals for diversity through the Board composition review process as part of the Board’s annual self-assessment process.

Director candidates recommended by stockholders

According to our Bylaws, a stockholder or a group of up to 25 stockholders owning 3% or more of the shares of our capital stock continuously for at least three years may nominate, and include in our proxy materials for an annual meeting of stockholders, director candidates constituting up to 20% of the Board, but not less than two, elected by the holders of our capital stock, provided the stockholder (or group) and each nominee satisfies the requirements specified in our Bylaws.

Stockholders may submit recommendations for director candidates to the Nominating and Corporate Governance Committee by sending the individual’s name and qualifications to our corporate secretary, who will forward all recommendations to the Committee.

|

Teladoc Health, Inc. |

The Nominating and Corporate Governance Committee will evaluate any candidate recommended by stockholders against the same criteria and policies and procedures applicable to the evaluation of candidates proposed by directors or management. The Committee has full discretion in considering all nominations to the Board. Alternatively, stockholders who would like to nominate a candidate for director (in lieu of making a recommendation to the Committee) must comply with the requirements described in this proxy statement and our Bylaws. See “Additional Information—Procedures for Submitting Stockholder Proposals” on page 81.

Communications with directors

You may communicate directly with any member or committee of the Board by writing to our principal executive office at:

|

Teladoc Health Board of Directors |

Please specify to whom your letter should be directed. Our corporate secretary reviews all correspondence and regularly forwards to the Board a summary of all correspondence and copies of correspondence that, in his or her opinion, deals with the functions of the Board or its committees or that he or she otherwise determines requires the attention of any member, group or committee of the Board.

Interested parties who wish to communicate with non-management directors, or with the presiding director of the Board’s executive sessions, may contact:

Related-party transactions

Our Board reviews and approves transactions with any “related party,” which includes directors, executive officers and holders of 5% or more of our capital stock and their affiliates. Pursuant to our written Related-Party Transaction Policy and Procedures, the Audit Committee reviews the relevant facts and circumstances of the transaction, taking into account, among other factors that are appropriate, whether the transaction is inconsistent with our or our stockholders’ interests, whether the transaction is on terms comparable to those that could be obtained in a transaction with an unrelated third party under the same or similar circumstances, and the extent of the related party’s interest in the transaction. No director may participate in any approval of a related-party transaction to which he or she is a related party.

Certain types of transactions, which would otherwise require individual review, have been pre-approved by the Audit Committee. These types of transactions include, for example, compensation to a director or executive officer where the compensation is required to be disclosed in our proxy statement or transactions where the interest of the related party arises only by way of a directorship or minority stake in another organization that is a party to the transaction. Additionally, according to our Related-Party Transaction Policy and Procedures, all related-party transactions are required to be disclosed in applicable filings as required by the Securities Act of 1933, as amended, and the Exchange Act and related rules. All related-party transactions are required to be disclosed to the full Board.

In 2023, we entered into a contract with Cedar Gate Technologies (“Cedar Gate”) for data and value-based analytics tools. Mr. Snow, the Chairman of our Board, is the Chief Executive Officer at Cedar Gate and owns approximately 10% of its outstanding capital stock. Pursuant to this contract, we will pay approximately $6.3 million to Cedar Gate over the three-year term, which includes an option for us to terminate after one year. There was no other transaction or series of similar transactions during 2023 to which we were or will be a party for which the amount involved exceeds or will exceed $120,000 and in which any related party had or will have a direct or indirect material interest.

Director compensation

Non-employee director compensation program

Our Board’s non-employee director compensation program is reflective of our continued growth and shifts in market practice, and is designed to provide a total compensation package that we feel will attract and retain, on a long-term basis, high-caliber non-employee directors and support the alignment of interests between our directors and long-term stockholders. The Board may amend, modify or terminate the program at any time. The program is reviewed regularly by the Compensation Committee and the full Board and references the policies and pay practices of a peer group of similar companies selected by the Committee in consultation with Aon.

Under the program, all non-employee directors receive a mix of cash and equity compensation. Cash compensation consists of annual retainers earned for serving on our Board, with additional retainers earned for serving as members of the committees of our Board or as chairpersons of the Board or its committees. Cash retainers are prorated for partial years of service. No additional compensation is paid to the chairperson or members of the Executive Committee.

Equity compensation consists of an initial equity award when a non-employee director is elected or appointed to the Board (“Initial Awards”) and an annual equity award on the date of our annual meeting to continuing non-employee directors who have served on the Board for at least six months (“Annual Awards”). Initial Awards are in the form of restricted stock units (“RSUs”), with one-third of the award vesting on the first anniversary of the grant date, and then in eight substantially equal quarterly installments over the subsequent two years. Annual Awards issued are also in the form of RSUs, which vest on the earlier of the first anniversary of the grant date or the day immediately prior to the date of the next annual meeting occurring after the date of grant. All outstanding unvested Initial Awards and Annual Awards also vest upon a change in control. The value of Initial Awards and Annual Awards is determined using the closing price of our common stock on the NYSE on the date of the award. The Board has reserved discretion under the program to pay all or a portion of the equity awards in any combination of equity-based awards available for grant under the any applicable equity incentive plan then-maintained by us.

The table below summarizes compensation provided under the program during 2023. Following the annual review undertaken by the Board, and after consultation with Aon, the Compensation Committee elected to revise the policy, effective January 1, 2024, to reduce the value of.

| Annual cash retainers | ($) |

|---|---|

| All non-employee directors | 45,000 |

| Chairman of the Board | 50,000 |

| Committee chairs: | |

| Audit committee | 20,000 |

| Compensation committee | 20,000 |

| Nominating and corporate governance committee | 10,000 |

| Quality of care and patient safety committee | 10,000 |

| Committee members: | |

| Audit committee | 10,000 |

| Compensation committee | 7,500 |

| Nominating and corporate governance committee | 5,000 |

| Quality of care and patient safety committee | 5,000 |

| Equity-based awards | ($) |

| Initial awards | 250,000 |

| Annual awards | 225,000 |

Deferred compensation plan for non-employee directors

We maintain a Deferred Compensation Plan for non-employee directors (the “Deferred Compensation Plan”) that permits our non-employee directors to defer payment of all or a portion of the awards of restricted stock or RSUs granted to them for their service as a director. A participant’s election to defer receipt of these awards must generally be made prior to the year to which the stock award relates (or, for a newly nominated director, within 30 days following the date of the commencement of the director’s service as a director).

Deferred awards are credited to an account in an equal amount of deferred stock units with dividend equivalent rights. Dividend equivalent rights entitle a participant, as of a dividend payment date, to have credited to the participant’s account under the plan a number of additional deferred stock units equal to the amount of any ordinary cash dividend paid by us on the number of shares of common stock equivalent to the number of deferred stock units in the participant’s deferred compensation account as of the record date for the dividend, divided by the fair market value of one share of common stock on the dividend payment date. Deferred stock units (including any additional deferred stock units resulting from dividend equivalent rights) are subject to the same vesting or other forfeiture conditions that would have otherwise applied to the deferred awards. For each deferred stock unit granted under the Deferred Compensation Plan, we will issue to the participant one share of our common stock (or, at the election of the Compensation Committee, an equivalent cash amount based on the fair market value of a share of common stock on the date immediately preceding the payment date) on the first to occur of:

- within 90 days following the date that is 30 days, five years or ten years after the participant’s separation from service, as elected by the participant in the applicable deferral election

- immediately prior to, on, or within 30 days following a change in control

- upon the participant’s death. If the participant is a “specified employee” within the meaning of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), the payment will instead be made on the later to occur of the scheduled distribution date and the first day of the seventh month following the date of the participant’s separation from service (within the meaning of Section 409A of the Code) or, if earlier, the date of the participant’s death

Executive compensation

Proposal 2 Advisory vote on executive compensation

This proposal requests that our stockholders cast a non-binding, advisory vote to approve the compensation of our named executive officers identified in the section titled “Compensation Discussion and Analysis” set forth below in this proxy statement. This proposal, commonly known as a “Say-on-Pay” proposal, gives our stockholders the opportunity to express their views on our named executive officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement. Accordingly, we ask our stockholders to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the Company’s stockholders hereby approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in this proxy statement pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, the Summary Compensation Table and the other related tables and disclosures.”

Details concerning how we implement our compensation philosophy and structure our compensation programs to meet the objectives of our compensation program are provided in the section titled “Compensation Discussion and Analysis” set forth below in this proxy statement. In particular, we discuss how we design performance-based compensation programs and set compensation targets and other objectives to maintain a close correlation between executive pay and our performance.

The Compensation Committee believes the support received from stockholders last year demonstrates that our stockholders strongly approve of the philosophy, strategy, objectives and implementation of our executive compensation programs. After considering this result and engagement with stockholders, and following our annual review of our executive compensation philosophy, the Committee decided to retain our overall approach to executive compensation. However, we have adjusted our compensation program in response to stockholder feedback by further emphasizing long performance periods for performance-based restricted stock units and altering our 2024 equity grant practices to reduce our burn rate. We believe our 2023 named executive officer compensation demonstrates our commitment to aligning executive pay with corporate performance, and that our executive compensation program is aligned with stockholder interests and merits continued stockholder support.

This vote is advisory and will not be binding upon us, the Board or the Compensation Committee, nor will it create or imply any change in the duties of us, the Board or the Committee. The Committee will consider the outcome of the vote when considering future executive compensation decisions. The Board values constructive dialogue on executive compensation and other significant governance topics with our stockholders and encourages all stockholders to vote their shares on this important matter.

Our Board has determined that providing a stockholder advisory vote to approve the compensation of our named executive officers every year represents a best practice in corporate governance, and although our Board will consider the outcome of the advisory vote on Say-on-Pay frequency in Proposal 3. it is expected the next Say-on-Pay vote will occur at the 2025 annual meeting of stockholders.

Executive officers

|

Career highlights TELADOC HEALTH, INC.

AMERICAN EXPRESS

PEPSICO

|

Other current directorships

Education

|

|

Career highlights TELADOC HEALTH, INC.

LIVONGO

TESLA

E*TRADE FINANCIAL

APPLIED MATERIALS, INC.

|

Other current directorships Mr. Geshuri sits on several start-up and academic advisory boards, including:

Education

|

|

Career highlights TELADOC HEALTH, INC.

CARECENTRIX

YESHIVA UNIVERSITY

MEDCO HEALTH SOLUTIONS

|

Education

|

|

Career highlights TELADOC HEALTH, INC.

ACTIVEHEALTH MANAGEMENT

MARSH MCCLENNAN

CAMBRIDGE TECHNOLOGY PARTNERS

|

Education

|

|

Career highlights TELADOC HEALTH, INC.

AMAZON WEB SERVICES

HIA TECHNOLOGIES, INC.

UNITED HEALTH GROUP

JOHNSON & JOHNSON

|

Education

|

|

Career highlights TELADOC HEALTH, INC.

WELLPOINT (now ELEVANCE HEALTH) and WELLCHOICE, INC.

|

Education

|

|

Career highlights TELADOC HEALTH, INC.

AETNA

SANDBOX INDUSTRIES/BLUE VENTURE FUND

BANK OF AMERICA

|

Other current directorships

Education

|

|

Career highlights TELADOC HEALTH, INC.

INDEPENDENCE HOLDING COMPANY

PAUL HASTINGS LLP

FEDEX CORPORATION

SULLIVAN & CROMWELL LLP

|

Recognitions

Education

|

|

Career highlights TELADOC HEALTH, INC.

TRUVERIS

EXPEDIA

MATCH.COM

KRAFT

FRITO-LAY

|

Other current directorships

Education

|

|

Career highlights TELADOC HEALTH, INC.

PROVIDENCE

W MEDICAL GROUP

MED STAT INCORPORATED

|

Other current engagements

Education

|

Compensation discussion and analysis

Named executive officers and overview

In this Compensation Discussion and Analysis, we address our philosophy, programs and processes related to the compensation paid or awarded for 2023 to our named executive officers, the overall objectives of our compensation program and the elements of our compensation program. We also explain how and why the Compensation Committee arrived at specific material compensation decisions during the year.

Jason Gorevic Former chief executive officer(1) |

Mala Murthy Interim chief executive officer and principal financial officer |

Laizer Kornwasser President, enterprise growth and global markets |

Michael Waters Chief operating officer |

Adam C. Vandervoort Chief legal officer and secretary |

- Ms. Murthy, who served as our Chief Financial Officer for all of fiscal 2023, became our interim Chief Executive Officer and Principal Financial Officer on April 5, 2024, replacing Mr. Gorevic.

The primary objectives of our executive compensation program are to retain key executives, attract new talent, link compensation to achievement of short- and long-term business objectives and align the interests of our executives with those of our long-term stockholders. We believe our 2023 named executive officer compensation demonstrates our commitment to aligning executive pay with corporate performance.

Compensation tables

2023 summary compensation table

| Name and principal position |

Year | Salary ($) |

Bonus ($) |

Stock awards(1) ($) |

Option awards(1) ($) |

Non-equity incentive plan compensation(2) ($) |

All other compensation ($) |

Total ($) |

|---|---|---|---|---|---|---|---|---|

| Jason Gorevic* Former chief executive officer |

2023 | 764,167 | – | 10,000,006 | – | 836,363 | 13,200(3) | 11,613,736 |

| 2022 | 695,833 | – | 10,000,020 | – | 168,000 | 12,200 | 10,876,053 | |

| 2021 | 654,167 | – | 10,000,131 | – | 972,000 | 11,600 | 11,637,898 | |

| Mala Murthy* Interim chief executive officer and principal financial officer |

2023 | 516,667 | – | 4,999,975 | – | 415,000 | 13,200(3) | 5,944,842 |

| 2022 | 493,333 | – | 6,799,959 | 2,399,973 | 243,800 | 12,200 | 9,949,265 | |

| 2021 | 454,167 | – | 3,249,841 | – | 415,000 | 11,600 | 4,130,608 | |

| Laizer Kornwasser President, enterprise growth and global markets |

2023 | 500,000 | – | 4,499,980 | – | 465,000 | – | 5,464,980 |

| 2022 | 94,697 | 550,000(4) | 6,999,992 | – | 500,000 | – | 8,144,689 | |

| Michael Waters Chief operating officer |

2023 | 470,000 | – | 4,000,012 | – | 320,000 | 7,833(3) | 4,797,845 |

| 2022 | 205,625 | 775,000(4) | 5,000,013 | – | 352,500 | – | 6,333,138 | |

| Adam C. Vandervoort Chief legal officer and secretary |

2023 | 446,667 | – | 2,849,978 | – | 226,000 | 13,200(3) | 3,535,845 |

| 2022 | 425,000 | – | 3,349,988 | 1,339,995 | 153,700 | 12,200 | 5,280,883 | |

| 2021 | 394,167 | – | 2,499,978 | – | 245,000 | 11,600 | 3,150,745 |

*Ms. Murthy, who served as our Chief Financial Officer for all of fiscal 2023, became our interim Chief Executive Officer and Principal Financial Officer on April 5, 2024, replacing Mr. Gorevic.

- Represents the aggregate grant date fair value of awards granted during the year referenced, computed in accordance with ASC Topic 718, excluding the effect of estimated forfeitures. For additional information about these awards, please see Note 13 to our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on February 23, 2024. The maximum possible value of the PSUs granted in 2023, based on the closing price per share of our common stock on the date they were granted, was as follows:

- Amounts listed were earned under our annual cash incentive program.

- Represents company matching contributions to the named executive officer's 401(k) plan account.

- Represents one-time signing bonus received upon commencement of employment.

2023 Grants of plan-based awards table

| Name | Incentive plan(1) |

Grant date(2) |

Estimated future payouts under non-equity incentive plan awards(3) |

Estimated future payouts under equity incentive plan awards(4) |

All other stock awards: number of shares of stock or units (#) |

All other option awards: number of securities underlying options (#) |

Exercise or base price of option awards ($/sh) |

Grant date fair value of stock and option awards ($)(5) |

||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Threshold ($) |

Target ($) |

Maximum ($) |

Threshold ($) |

Target ($) |

Maximum ($) |

|||||||

| Jason Gorevic | 2015 Incentive award Plan | 3/3/2023(6) | – | 186,012 | 344,123 | 5,000,003 | ||||||

| 2015 Incentive award Plan | 3/3/2023(7) | 186,012 | 5,000,003 | |||||||||

| Bonus program | – | – | 932,400 | 1,864,800 | ||||||||

| Mala Murthy | 2015 Incentive award Plan | 3/3/2023(6) | – | 93,005 | 172,059 | 2,499,974 | ||||||

| 2015 Incentive award Plan | 3/3/2023(7) | 93,006 | 2,500,001 | |||||||||

| Bonus program | – | – | 390,000 | 780,000 | ||||||||

| Laizer Kornwasser | 2015 Incentive award Plan | 3/3/2023(6) | – | 83,705 | 154,854 | 2,249,990 | ||||||

| 2015 Incentive award Plan | 3/3/2023(7) | 83,705 | 2,249,990 | |||||||||

| Bonus program | – | – | 500,000 | 1,000,000 | ||||||||

| Michael Waters | 2015 Incentive award Plan | 3/3/2023(6) | – | 74,405 | 137,649 | 2,000,006 | ||||||

| 2015 Incentive award Plan | 3/3/2023(7) | 74,405 | 2,000,006 | |||||||||

| Bonus program | – | – | 352,500 | 705,000 | ||||||||

| Michael Waters | 2015 Incentive award Plan | 3/3/2023(6) | – | 53,013 | 98,074 | 1,424,989 | ||||||

| 2015 Incentive award Plan | 3/3/2023(7) | 53,013 | 1,424,989 | |||||||||

| Bonus program | – | – | 247,500 | 495,000 | ||||||||

- The award was granted under the 2015 Incentive Award Plan or our annual cash bonus program, as indicated in this column.

- Awards granted on March 3, 2023 were approved on February 16, 2023.

- The portion of the annual bonus based on corporate performance may range from zero to a maximum of no more than 200% of the target bonus. However, the individual component of each applicable named executive officer's award is not based on achievement of any pre-established performance goals and may result in an award that exceeds the maximum shown here. Additional detail regarding the determination of cash bonuses is included above under “Compensation Discussion and Analysis — Elements of Compensation — Cash Bonuses.” Actual payments are set forth in the ”Summary Compensation Table“ above.

- The EBITDA PSUs and Revenue PSUs granted in 2023 may range from zero to a maximum of no more than 200% of the target number of shares, while the Net Income PSUs granted in 2023 may be zero or 125% of the target number of shares.

- Amounts in this column reflect the aggregate grant date fair value of awards granted during 2023 computed in accordance with ASC Topic 718, excluding the effect of estimated forfeitures. The assumptions used in calculating these amounts are included in Note 13 to our Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on February 23, 2024.

- The PSU award is earned based on our attainment of adjusted EBITDA, revenue and net income targets. To the extent earned, (i) the EBITDA PSUs would vest as to one-third of any earned PSUs on March 1, 2024 and as to the remaining two-thirds in eight substantially equal quarterly installments over the subsequent two years, (ii) the Revenue PSUs would vest as to two-thirds of any earned PSUs on March 1, 2025 and as to the remaining one-third in four substantially equal quarterly installments over the subsequent year and (iii) the Net Income PSUs vest on March 1, 2026, in each case as described above in the section titled “Compensation Discussion and Analysis — Elements of Compensation — Equity awards,” and subject to the holder's continued employment with us through the applicable vesting date and potential accelerated vesting as described in the section titled “Potential Payments upon Termination or Change in Control.”

- The RSU award vests as to one-third on March 1, 2024 and the remaining two-thirds in eight substantially equal quarterly installments thereafter, subject to the holder's continued employment with us through the applicable vesting date and potential accelerated vesting as described in the section titled “Potential Payments upon Termination or Change in Control.”

2023 Outstanding equity awards at fiscal year-end table

| Option awards | Stock awards | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Name | Grant date |

Number of securities underlying unexercised options exercisable |

Number of securities underlying unexercised options unexercisable |

Option exercise price ($) |

Option expiration date |

Number of shares or units of stock that have not vested (#) |

Market value of shares or units of stock that have not vested ($) |

Equity incentive plan awards: number of unearned shares, units or other rights that have not vested (#) |

Equity incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested ($) |

| Jason Gorevic | 3/3/2023(1) | 186,012 | 4,008,559 | – | – | ||||

| 3/3/2023(2) | – | – | 37,202 | 801,703 | |||||

| 3/3/2023(3) | – | – | 74,405 | 1,603,428 | |||||

| 3/3/2023(4) | 74,405 | 1,603,428 | – | – | |||||

| 3/1/2022(5) | 28,075 | 605,016 | – | – | |||||

| 3/1/2022(6) | – | – | 6,738 | 145,204 | |||||

| 3/2/2021(7) | 7,648 | 164,814 | – | – | |||||

| 3/2/2021(8) | 2,915 | 62,818 | – | – | |||||

| 3/2/2021(9) | 5,782 | 124,602 | – | – | |||||

| 3/1/2018(10) | 169,893 | – | 38.55 | 3/1/2028 | |||||

| 3/3/2017(10) | 400,116 | – | 22.30 | 3/3/2027 | |||||

| 3/7/2016(10) | 383,649 | – | 12.21 | 3/7/2026 | |||||

| Mala Murthy | 3/3/2023(1) | 93,006 | 2,004,279 | – | – | ||||

| 3/3/2023(2) | – | – | 18,601 | 400,852 | |||||

| 3/3/2023(3) | – | – | 37,202 | 801,703 | |||||

| 3/3/2023(4) | 37,202 | 801,703 | – | – | |||||

| 6/1/2022(5) | 12,264 | 264,289 | – | – | |||||

| 6/1/2022(11) | 70,534 | 70,542 | 32.62 | 5/31/2032 | |||||

| 3/1/2022(5) | 16,845 | 363,010 | – | – | |||||

| 3/1/2022(6) | – | – | 4,043 | 87,127 | |||||

| 3/2/2021(7) | 2,486 | 53,573 | – | – | |||||

| 3/2/2021(8) | 945 | 20,365 | – | – | |||||

| 3/2/2021(9) | 1,878 | 40,471 | – | – | |||||

| 6/24/2019(10) | 36,882 | – | 62.75 | 6/24/2019 | |||||

| Laizer Kornwasser | 3/3/2023(1) | 83,705 | 1,803,843 | – | – | ||||

| 3/3/2023(2) | – | – | 16,741 | 360,769 | |||||

| 3/3/2023(3) | – | – | 33,482 | 721,537 | |||||

| 3/3/2023(4) | 33,842 | 721,537 | – | – | |||||

| 11/1/2022(1) | 161,588 | 3,482,221 | – | – | |||||

| Michael Waters | 3/3/2023(1) | 74,405 | 1,603,428 | – | – | ||||

| 3/3/2023(2) | – | – | 14,881 | 320,686 | |||||

| 3/3/2023(3) | – | – | 29,762 | 641,371 | |||||

| 3/3/2023(4) | 29,762 | 641,371 | – | – | |||||

| 8/1/2022(5) | 79,237 | 1,707,557 | – | – | |||||

| Adam C. Vandervoort | 3/3/2023(1) | 53,013 | 1,142,430 | – | – | ||||

| 3/3/2023(2) | – | – | 10,603 | 228,495 | |||||

| 3/3/2023(3) | – | – | 21,205 | 456,968 | |||||

| 3/3/2023(4) | 21,205 | 456,968 | – | – | |||||

| 6/1/2022(11) | 39,383 | 39,385 | 32.62 | 5/31/2032 | |||||

| 3/1/2022(5) | 9,405 | 202,678 | – | – | |||||

| 3/1/2022(6) | – | – | 2,257 | 48,638 | |||||

| 3/2/2021(7) | 1,912 | 41,204 | – | – | |||||

| 3/2/2021(8) | 730 | 15,732 | – | – | |||||

| 3/2/2021(9) | 1,446 | 31,161 | – | – | |||||

| 3/3/2023(10) | 14,058 | – | 38.55 | 3/1/2018 | |||||

- One-third of the RSU award vests on March 1, 2024, with the remainder vesting in eight substantially equal quarterly installments over the subsequent two years, subject to the holder's continued employment with us through the applicable vesting date and potential accelerated vesting as described in the section titled “Potential Payments upon Termination or Change in Control.”

- The PSU award is earned based on our attainment of a 2025 net income target and, to the extent earned, vests on March 1, 2026, as described above in the section titled “Compensation Discussion and Analysis — Elements of Compensation — Equity awards,” and subject to the holder's continued employment with us through the applicable vesting date and potential accelerated vesting as described in the section titled “Potential Payments upon Termination or Change in Control.” The PSU award may be zero or 125% of the target number of shares.

- The PSU award is earned based on our attainment of a 2024 revenue target and, to the extent earned, vests as to two-thirds of any earned PSUs on March 1, 2025 and as to the remaining one-third in substantially equal quarterly installments over the subsequent year, as described above in the section titled “Compensation Discussion and Analysis — Elements of Compensation — Equity awards,” and subject to the holder's continued employment with us through the applicable vesting date and potential accelerated vesting as described in the section titled “Potential Payments upon Termination or Change in Control.”

- The PSU award was earned based on our attainment of a 2023 adjusted EBITDA target and vested as to one-third of any earned PSUs on March 1, 2024 and as to the remaining two-thirds in substantially equal quarterly installments over the subsequent two years, as described above in the section titled “Compensation Discussion and Analysis — Elements of Compensation — Equity awards,” and subject to the holder's continued employment with us through the applicable vesting date and potential accelerated vesting as described in the section titled “Potential Payments upon Termination or Change in Control.”

- One-third of the RSU award vests on the first anniversary of the grant date, with the remainder vesting in eight substantially equal quarterly installments over the subsequent two years, subject to the holder's continued employment with us through the applicable vesting date and potential accelerated vesting as described in the section titled “Potential Payments upon Termination or Change in Control.”

- The PSU award is earned based on our attainment of an adjusted EBITDA margin target over a three-year performance period ending on December 31, 2024 and, to the extent earned, vests on March 1, 2025, and subject to the holder's continued employment with us through the applicable vesting date and potential accelerated vesting as described in the section titled “Potential Payments upon Termination or Change in Control.”

- The RSU award vests in three substantially equal annual installments on each of the first three anniversaries of the grant date, subject to the holder's continued employment with us through the applicable vesting date and potential accelerated vesting as described in the section titled “Potential Payments upon Termination or Change in Control.”

- The PSU award was earned based on our attainment of adjusted EBITDA and annual recurring revenue synergies targets over a two-year period ending on December 31, 2022 and vested as to half of any earned PSUs on March 2, 2023 and as to the remaining half on March 2, 2024,, subject to the holder's continued employment with us through the applicable vesting date and potential accelerated vesting as described in the section titled “Potential Payments upon Termination or Change in Control.”

- The PSU award was earned based on our attainment of a 2021 revenue target and vested as to one-third of any earned PSUs on March 2, 2022 and as to the remaining two-thirds in substantially equal annual installments over the subsequent two years, subject to the holder's continued employment with us through the applicable vesting date and potential accelerated vesting as described in the section titled “Potential Payments upon Termination or Change in Control.”

- The option vests as to 25% of the total shares underlying the option on the first anniversary of the grant date and in substantially equal monthly installments over the ensuing 36 months, subject to the holder's continued employment with us through the applicable vesting date and potential accelerated vesting as described in the section titled “Potential Payments upon Termination or Change in Control.”

- The option vests as to one-third of the total shares underlying the option on the first anniversary of the grant date and in substantially equal monthly installments over the ensuing 24 months, subject to the holder's continued employment with us through the applicable vesting date and potential accelerated vesting as described in the section titled “Potential Payments upon Termination or Change in Control.”

2023 Option exercises and stock vested table

| Option awards | Stock awards | |||

|---|---|---|---|---|

| Name | Number of shares acquired on exercise (#) |

Value realized on exercise ($) |

Number of shares acquired on vesting (#) |

Value realized on vesting ($) |

| Jason Gorevic | – | – | 84,115 | 2,089,972 |

| Mala Murthy | – | – | 49,529 | 1,198,438 |

| Laizer Kornwasser | – | – | 80,794 | 1,345,220 |

| Michael Waters | – | – | 56,596 | 1,444,898 |

| Adam C. Vandervoort | – | – | 23,322 | 576,589 |

2023 Pension benefits

Employment, severance and change in control arrangements

Each of our named executive officers has entered into an employment or severance agreement that entitles the named executive officer to severance payments and benefits in the event of certain terminations of employment or upon a change in control of Teladoc Health. We have also adopted the Severance Plan under which certain of our employees who are not otherwise entitled to any severance pay or benefits or prior notice of employment termination (or pay in lieu of such prior notice) under any binding contract or agreement with us, are eligible for severance payments and benefits in connection with a qualifying termination of employment. If an eligible employee has entered into an employment or severance agreement that entitles him or her to severance payments and benefits that would be less favorable than such severance payments or benefits he or she would be entitled to under the Severance Plan, the Severance Plan will control.

Jason Gorevic

Our employment agreement with Mr. Gorevic was for an unspecified term and included an annual target bonus opportunity of at least 100% of his annual base salary. In addition, Mr. Gorevic was eligible to earn a potential bonus for over-performance of at least 150% of his annual base salary. As a result of Mr. Gorevic’s termination without cause on April 5, 2024, Mr. Gorevic became eligible for the severance benefits described below.

Under his employment agreement, upon his termination by us without cause or his resignation for good reason, subject to his timely executing a release of claims in our favor, he would have been entitled to receive:

- 18 months of continued base salary and life insurance

- any earned but unpaid bonus for the year prior to the year of termination

- up to 18 months of premiums for continued medical, dental or vision coverage pursuant to COBRA, if elected

- a pro rata portion of the bonus he would have earned for the year of termination

- accelerated vesting of time-based equity awards scheduled to vest within 12 months following the date of termination and continued eligibility to vest in awards subject to performance-based vesting conditions if and to the extent such performance conditions are satisfied during that 12-month period

Under his employment agreement, upon his termination by us without cause or his resignation for good reason, in either case within 12 months following a change in control, subject to his timely executing a release of claims in our favor, Mr. Gorevic would have been entitled to receive the following in lieu of the severance benefits described above:

- a lump-sum payment equal to 150% of his base salary plus target bonus opportunity

- any earned but unpaid bonus for the year prior to the year of termination

- 18 months of continued life insurance

- up to 18 months of premiums for continued medical, dental or vision coverage pursuant to COBRA, if elected

- a pro rata portion of the bonus he would have earned for the year of termination

- accelerated vesting of his time-based equity awards and continued eligibility to vest in awards subject to performance-based vesting conditions if and to the extent such performance conditions are thereafter satisfied

Mr. Gorevic’s employment agreement contains restrictive covenants pursuant to which he has agreed to refrain from competing with us or soliciting our employees or customers for a period of 18 months following his termination of employment, provided that he may perform services for competitors with multiple lines of business if he (i) does not participate in any material respect in the competing business and, (ii) if multiple lines of business report to him, any competing business lines account for less than 15% of the net revenue over the prior year for the business lines reporting to him.

- “Cause” generally means, subject to certain notice requirements and cure rights, Mr. Gorevic’s: (i) willful and continued failure to substantially perform his duties to us (other than any such failure resulting from his incapacity due to disability), after demand for substantial performance is delivered by us that specifically identifies the manner in which we believe he has not substantially performed his duties; (ii) willful engaging in misconduct that is significantly injurious to us, monetarily, in reputation or otherwise, including any conduct that is in violation of our written employee workplace policies; or (iii) commission of any felony, or any crime involving dishonesty in respect to our business and affairs.

- “Good reason” generally means, subject to certain notice requirements and cure rights, a material reduction in the amount of Mr. Gorevic’s base salary, target bonus or duties, responsibilities or authority, the cessation of his service on the Board, a requirement that he relocate his residence or principal place of employment outside of the New York City metropolitan area, our material breach of his employment agreement or, if, in connection with or following a change in control, our common stock ceases to be publicly traded on a national securities exchange (unless Mr. Gorevic is the Chief Executive Officer of the ultimate parent entity or successor in such change in control and the common stock of such parent entity or successor is publicly traded).

CEO pay ratio

As required by Section 953(b) of the Dodd-Frank Act and Item 402(u) of Regulation S-K, we are providing the following information regarding the relationship between the annual total compensation of our employees and the annual total compensation of Mr. Gorevic, our former Chief Executive Officer. We consider the pay ratio specified herein to be a reasonable estimate, calculated in a manner intended to be consistent with Item 402(u) of Regulation S-K. We believe executive pay must be internally consistent and equitable to motivate our employees to create stockholder value. We are committed to internal pay equity, and our Compensation Committee monitors the relationship between the pay our executive officers receive and the pay our non-managerial employees receive.

Mr. Gorevic had 2023 annual total compensation of $11,613,736 as reflected in the 2023 Summary Compensation Table included in this proxy statement. Our median employee’s annual total compensation for 2023 was $101,448, as determined in the same manner as the total compensation for Mr. Gorevic. Based on this information, for 2023, the estimated ratio of the median of the annual total compensation of all of our employees (other than our CEO) to the annual compensation of our CEO was 1 to 114.